Asset Management

2019 Highlights

- Acquired asset management license from the Saudi CMA

- Reached total AUM of USD 2.1 billion

- More than doubled fixed income AUM to USD 427 million

- Khaleej Equity Fund was the top performing regional fund for the second consecutive year generating a return of 23.5%

- SICO Kingdom Equity Fund, a fund dedicated to investing in the Saudi market, is one of the most successful Saudi dedicated funds generating returns in excess of 20% for the second consecutive year

- Appointed as investment manager for Minors’ Estate Directorate’s fixed income and equity fund portfolio

Overview

SICO’s team of seasoned asset managers and investment professionals have consistently generated exceptional returns by utilizing an innovative, researchintensive investment strategy with an emphasis on methodical stock picking and prudent risk management across multiple asset classes in the GCC.

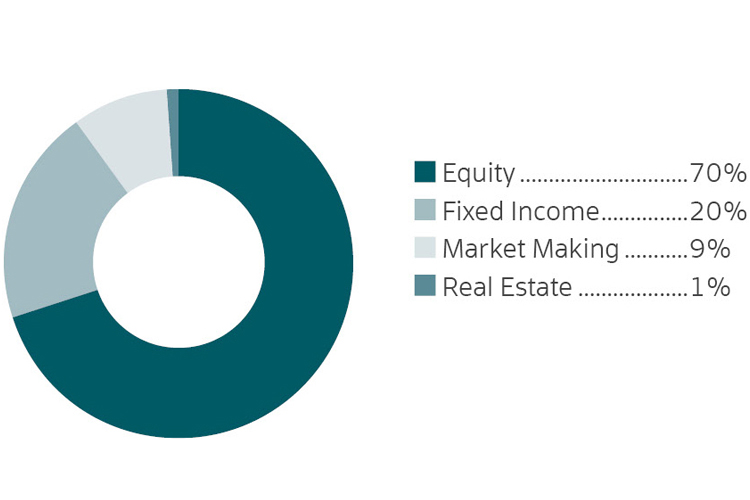

SICO continues to lead the market and gain the confidence of a loyal and expanding base of institutional and high net worth clients across the GCC. The division’s mandates cover conventional and Sharia-compliant equities, money market, and fixed income securities as well as the first Sharia-compliant real estate investment trust (REIT) listed on the Bahrain Bourse.

The asset management team also manages third party funds on behalf of leading regional financial institutions. SICO’s signature equity and fixed income funds have consistently outperformed their respective benchmarks earning top spots on the league tables year after year.

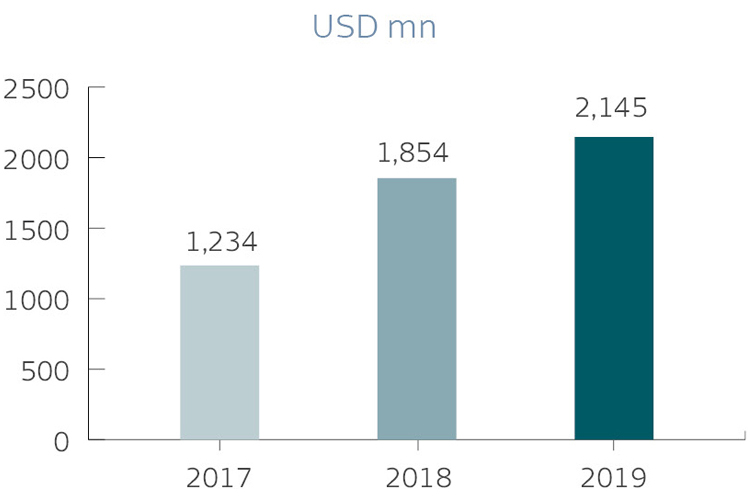

AUM Growth

AUM by Asset Class

2019 Operational Review

While the year began on a high note with GCC equity markets performing exceptionally well in the first half of 2019, the second half of the year witnessed significant profit-taking with markets across the region giving up much of their gains. Despite the volatility, SICO Asset Management delivered a 16% increase in total AUMs, which grew to USD 2.1 billion from USD 1.9 billion at the end of 2018.

In line with a long-term regional expansion strategy to generate cross-market synergies and create new value for investors, SICO capped off the year with a new license from the Saudi Capital Markets Authority (CMA) to extend asset management services in KSA. SICO’s direct penetration of the Saudi market positions the Bank strategically to serve a wider range of investors, including institutions, sovereign wealth funds, family offices, and private banks in a market that boasts tremendous potential. The new license represents a crucial pivot in the evolution of SICO’s asset management business and an opportunity to build a dedicated on-the-ground team.

In 2019, among a number of new mandates, SICO’s Asset Management Division was appointed by Bahrain’s Ministry of Justice, Islamic Affairs and Endowments as the investment manager for the fixed-income and equity portfolio of the Minors’ Estate Directorate. The new mandate will entail the management of a USD 20 million portfolio with the aim of creating more long-term value and enhancing income and dividend distribution payouts for its benefactors.

Equities

SICO’s Equity Asset Management Team manages three equity funds, including its top-performing SICO Kingdom Equity Fund (SKEF) and Khaleej Equity Fund (KEF) together with several discretionary portfolio management accounts. All of SICO’s equity funds continued to outperform exceeding 2018 figures with an increase of over 20% on the back of solid stock picking, driving SICO’s equity AUMs to USD 1.5 billion up from USD 1.3 billion in 2018 despite a significant wave of redemptions in the second half of the year.

The equities division has developed a robust pipeline of mandates from key institutional clients in the region, all of which are expected to materialize in 2020.

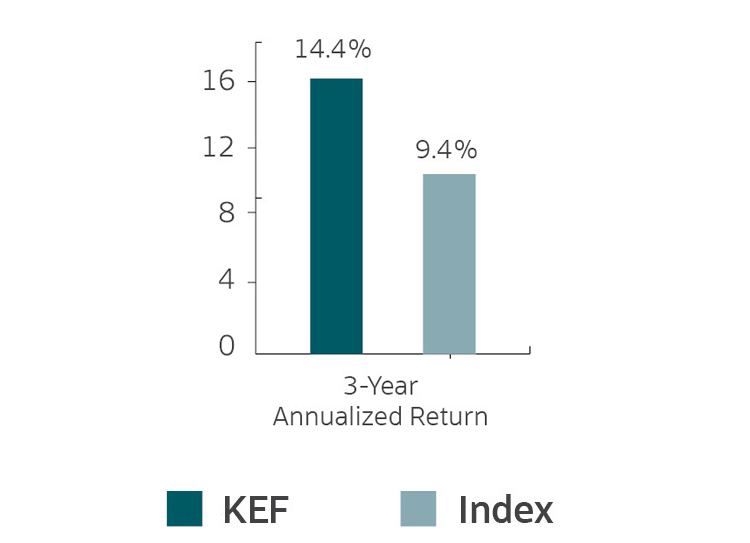

SICO’s flagship, Khaleej Equity Fund, which invests in equities listed on stock markets in the GCC and Egypt, ended 2019 with a return of 23.5%; maintaining its position as one of the top performing funds in the GCC.

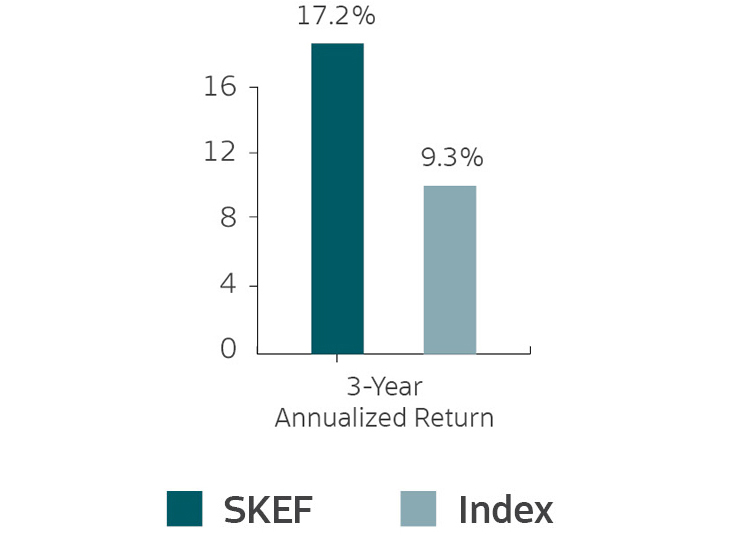

SICO’s top-performing Kingdom Equity Fund, an equity fund that gives investors exposure to the Saudi equity market, continues to outperform the league tables delivering positive returns of 22.5% in 2019. This was the second year in a row in which the fund produced returns in excess of 20%.

SICO’s Asset Management continues to successfully manage external funds on behalf of Riyad Bank and Al Ahli Bank of Kuwait, a 15-year long relationship that has seen SICO generate solid returns for both funds.

SICO Kingdom Equity Fund

Khaleej Equity Fund

| Fund Name | Launch Date | Principal Investment Focus | Benchmark | Peer Group | Return (January - December 2019) | Annualized Return |

|---|---|---|---|---|---|---|

| Khaleej Equity Fund | March 2004 | Equity securities listed on stock markets of GCC countries | S&P GCC Index | GCC | 23.5% vs benchmark 12.5% | 14.4% vs benchmark 9.4% (last three years) |

| SICO Kingdom Equity Fund | February 2011 | Equity securities listed in Saudi Arabia | Tadawul | Equity Saudi | 22.5% vs benchmark 11.9% | 17.2% vs benchmark 9.3% (last three years) |

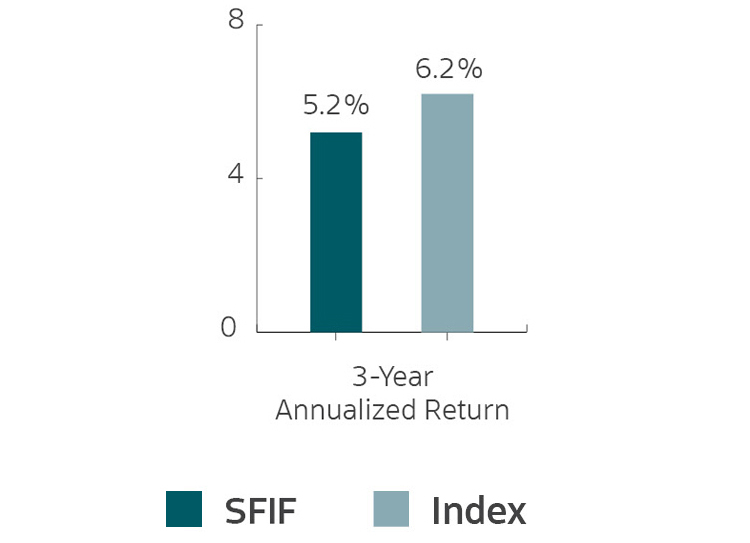

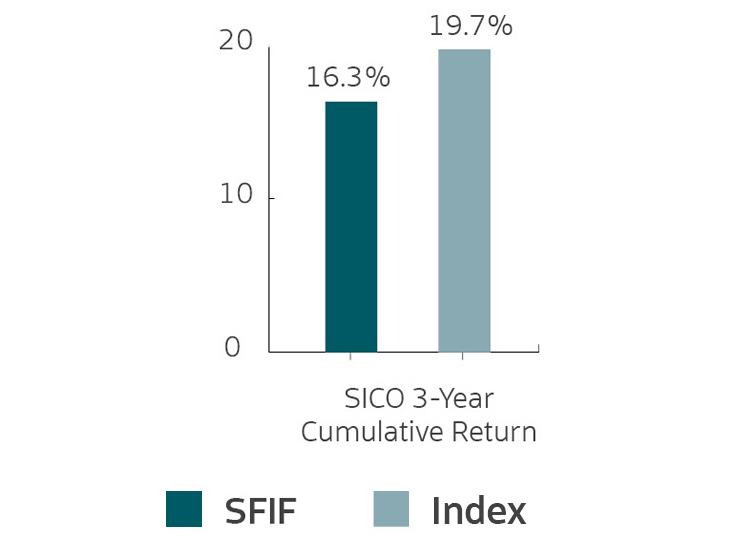

| SICO Fixed Income Fund | April 2013 | Government and corporate fixed income, sukuk, repo money market instruments, and other fixed income—related instruments | Barclays Emerging Markets GCC Bond Index | Fixed Income GCC | 10.6% vs benchmark 15.0% | 5.2% vs benchmark 6.2% (last three years) |

Fixed Income

2019 was a historic year for fixed income in the GCC. As the year drew to a close, investors saw doubledigit returns with the market achieving a milestone 15% at year-end, the region’s best performance to date on the back of budget deficit reducing measures that saw GCC credit spreads tighten to their lowest level in four years at 134 basis points, with the average yield now at just 3.16% compared to 4.65% at the start of the last year. The US Federal Reserve also played a role and delivered three rate cuts during the year to stave off a slowdown in global growth. Additional developments that drove regional bond markets included inclusion into the widely followed JP Morgan EM Bond index, Brexit, and most notoriously the international trade wars mainly between the US and China.

Against this backdrop, SICO’s fixed income asset management business more than doubled its AUMs in 2019 to USD 427 million up from USD 211 million in 2018. In addition to doubling its assets, the division also diversified its geographical reach in the region in terms of the sourcing of AUMs and grew its number of clients.

The flagship SICO Fixed Income Fund generated returns of 10.6% during 2019 in what transpired to become one of the best years for GCC fixed income. The Fund’s strong performance was primarily driven by lower benchmark rates after US Federal Reserve cut its rates, pushing up bond prices in the process. The Fund was, however, also well exposed to take advantage of other investment themes that drove regional bond performance such as inclusion into the widely followed JP Morgan EM Bond index, Brexit as well as international trade wars, mainly between the US and China. The Fund also swapped duration risk with credit risk and benefited from a combination of better fiscal balances and the implementation of budget deficit reducing measures by GCC states. The team’s strategy to overweight Bahrain also worked in the Fund’s favor as it ended the year as the best performing GCC sovereign fund, on the back of improving economic conditions and fiscal reforms, setting up the kingdom as a prime candidate for a rating upgrade in 2020.

The flagship SICO Fixed Income Fund generated returns of 10.6% during 2019 in what transpired to become one of the best years for GCC fixed income. The Fund’s strong performance was primarily driven by lower benchmark rates after US Federal Reserve cut its rates, pushing up bond prices in the process. The Fund was, however, also well exposed to take advantage of other investment themes that drove regional bond performance such as inclusion into the widely followed JP Morgan EM Bond index, Brexit as well as international trade wars, mainly between the US and China. The Fund also swapped duration risk with credit risk and benefited from a combination of better fiscal balances and the implementation of budget deficit reducing measures by GCC states. The team’s strategy to overweight Bahrain also worked in the Fund’s favor as it ended the year as the best performing GCC sovereign fund, on the back of improving economic conditions and fiscal reforms, setting up the kingdom as a prime candidate for a rating upgrade in 2020.

The team managed to capitalize on positive market developments to secure a number of advisory mandates in 2019 as well as their first money market portfolio, representing a further diversification of asset classes and mandate coverage.

SICO Fixed Income Fund Growth

Real Estate

SICO’s real estate asset management activities include the sub-investment management of the USD 30 million Eskan Bank Realt y Income Trust (EBRIT), a Sharia-compliant real estate investment trust (REIT) that invests in proper ties in Bahrain. Despite the liquidation of SICO’s USD 55 million US Real Estate Fund due to unfavorable market conditions, SICO continues to manage US proper ties that will eventually be liquidated as well.

2020 Outlook

In 2020, GCC bonds are expected to deliver total returns of about 4%, driven by carry trades on the back of solid regional fundamentals, easy monetary policy and an uptick in US treasury yields. Steepening across the curve is anticipated and growth takes the reins as the main driver of risk asset returns with easier financial conditions starting to filter through with global tensions beginning to ease, favoring emerging market and high yield bonds. Probable catalysts might materialize toward the end of the year with the Dubai Expo 2020 beginning in October and Saudi Arabia hosting the G20 summit in November. Nevertheless, it will be the outcome of the US and China trade war that will ultimately determine the path of future bond prices. On one hand, both have strong incentives to hit pause on their trade conflict across 2020, but it is also equally unlikely that a convincing deal will emerge given each nation’s strong stance.

Against this backdrop, SICO’s Asset Management Division has ambitious plans for the year ahead for both the equities and fixed income sides of the business.