Investment Banking

2019 Highlights

- Mandated as issue execution advisor, receiving agent, and allotment agent in National Bank of Bahrain acquisition of Bahrain Islamic Bank

- Mandated as Bahrain Receiving Agent, Execution Advisor for cross listing of Kuwait Finance House offer to aquire 100% of Ahli United Bank

- Mandated to arrange debt financing for a leading university in Bahrain

- Ongoing sub-investment manager of Eskan Bank Reality Income Trust for 3 years

Overview

SICO Investment Banking has successfully cemented its position as the leading advisor on Bahrain’s equity and debt capital markets transactions and as the partner of choice on high-profile IPO’s and M&A deals in the Kingdom. The Investment Banking Division’s team of professionals also delivers unique corporate and private advisory services including real estate advisory, capital restructuring, listing and cross-listing, fund setup, business valuation, privatization, and underwriting.

Over the years, the Investment Banking Division has taken the lead on a number of landmark transactions such as the Eskan Bank REIT, Bahrain’s first listed REIT (which the team continues to manage), the first perpetual tier 1 convertible capital securities issuance listed on the Bahrain Bourse for BBK, the first 100% listed acquisition through a share-swap deal on the local exchange for Gulf Hotel Group’s acquisition of Bahrain Tourism Company, the APM Terminals IPO, Bahrain’s most successful IPO in the past decade, and most recently, the acquisition of Bahrain Islamic Bank (BISB) by National Bank of Bahrain (NBB), one of the largest M&A transactions in the Kingdom to date.

2019 Operational Review

The Investment Banking Division continued to achieve new operational milestones in 2019 capping off the year as the mandated issue execution advisor, receiving agent, and allotment agent in the acquisition of Bahrain Islamic Bank (BISB) by National Bank of Bahrain (NBB), two of Bahrain’s most prominent banks, amid an ongoing wave of M&As in the GCC banking sector. The appointment stands as a testament to SICO’s 20-plus year track record as lead advisor on key transactions and to its position as a trusted local partner with unparalleled on-the-ground expertise in the Bahraini banking sector.

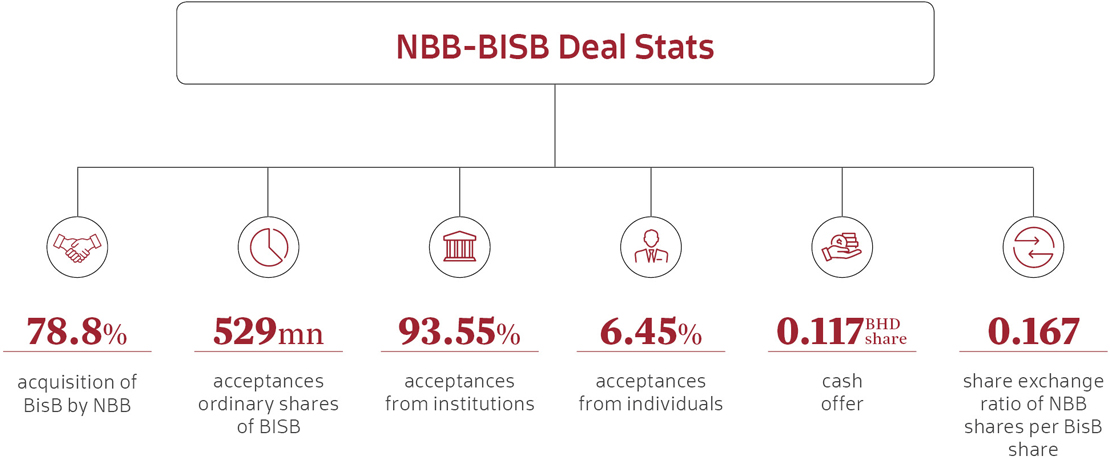

The BD 62 million deal saw NBB acquiring from the public market an additional 49.8% shares in BISB, on top of the 29.1% it already owned in BISB, to consolidate a post-transaction ownership of 78.8% in BISB, resulting in the consolidated NBB and BISB market capitalization to reach approximately BD 1.13 billion following the acquisition. As the issue execution advisor and receiving and allotment agent, SICO advised NBB on the various processes required for successful closure and received and managed the process of BISB shareholders participating in the offer including the announcement of satisfied conditionality thresholds and the settlement of payment and share issuance by NBB. The entire transaction was processed seamlessly in line with the Central Bank of Bahrain’s rules and regulations.

The Division also received a key mandate in 2019 as Bahrain Receiving Agent and Execution Advisor for the cross listing of Kuwait Finance House’s offer to acquire 100% of Ahli United Bank, a full mandate that is expected to close in 2020.

Additionally, in the education sector, SICO was mandated by a reputable local university to arrange up to BD 12 million in debt financing from both commercial banks and multilateral development banks for the construction of a new university campus in Bahrain.

The Investment Banking Division’s expertise in providing discrete private advisory services to businesses, government entities, and high-net-worth individuals came into play during the course of the year with the provision of private placement services to a large minority shareholder in a company in the real estate sector. The Investment Banking team conducted a valuation of the stake available for sale and prepared an investor presentation, which is currently used to market the transaction to potential private buyers.

In the insurance sector, SICO’s corporate advisory services were tapped by a leading insurance group in Bahrain to address their need for an increase in capital adequacy through portfolio rebalancing without an immediate capital injection. Additionally, the team also provided the same insurance group with white label services during the course of the year.

2020 Outlook

Going into 2020, the Investment Banking Division will build on momentum gained in 2019. As witnessed in 2019, the M&A wave across the financial services sector is expected to continue in 2020 and SICO, with its rich and recent track record of successful M&As, is poised to participate in more of these anticipated transactions.

Additionally, other sectors such as food and beverages have shown potential for consolidation and the Investment Banking Division is closely monitoring them to identify potential opportunities for the department. SICO will also continue its efforts to increase awareness about the Bahrain Investment Market (BIM) and encourage fast-growing companies in the kingdom with potential to list their shares in the BIM with SICO acting as their financial advisor and sponsor for the listing.

The continued diversification from energy by regional governments and their efforts towards fiscal consolidation is likely to push through privatizations, with recent announcements of potential IPOs for Bahrain’s airport and related entities. REITs are also expected to pick up as Bahrain’s sovereign interest rates continue to tighten following the successful launch and implementation of the government’s Fiscal Balance Program.

Apart from its capital market advisory and the M&A mandates, SICO will also continue to provide and expand its advisory services provided to private sector entities and family businesses.

The Division looks forward to the potential for expansion in Saudi Arabia after SICO received regulatory approval from the Saudi Capital Markets Authority to offer asset management services in the Kingdom. The Investment Banking Division is hopeful that an on-the-ground asset management presence in the GCC’s largest market can be a stepping stone towards the full execution of SICO’s regional expansion strategy by extending capital markets transaction services in the Kingdom.