Introduction

Corporate governance broadly refers to the mechanisms, processes and relations by which organizations are controlled and governed. Corporate governance includes the processes through which organizations’ objectives are set and pursued in the context of the social, regulatory and market environment. The framework of corporate governance assists the Board of Directors to ensure accountability, fairness and transparency in an organization’s relationship with its all stakeholders.

The ideal corporate governance framework consists of:

- Explicit and implicit contracts between the company and the stakeholders for distribution of responsibilities, rights and rewards.

- Procedures for reconciling the sometimes conflicting interests of stakeholders in accordance with their duties, privileges, and roles.

- Procedures for proper supervision, control, and information-flows to serve as a system of checks-and-balances.

A good Corporate Governance policy ensures transparency, provides protection for investors, other stakeholder’s interests and enhances companies' value.

The purpose of formulating Corporate Governance policy is to establish best-practice corporate governance principles in functioning of SICO B.S.C (c) (“the Bank” or “SICO”) and its subsidiaries.

This Corporate Governance policy provides frameworks for setting the principles of effective Corporate Governance in SICO and its subsidiaries taking into the consideration of following:

- Commercial Companies Law issued by the Ministry of Industry, Commerce and Tourism.

- Corporate governance principles issued by the Ministry of Industry, Commerce and Tourism as "The Corporate Governance Code".

- International best practice corporate governance standards set by bodies such as the Basel Committee for Banking Supervision.

- Principles incorporated in High Level Controls Module of the Central Bank of Bahrain.

Commitment

SICO is committed to upholding the highest standards of corporate governance. This entails complying with regulatory requirements, protecting the rights and interests of all stakeholders, enhancing shareholder value, and achieving organizational efficiency. The Bank has Board-approved policies for risk management, compliance and internal controls, in accordance with the latest rules and guidelines from the Central Bank of Bahrain (CBB).

The adoption and implementation of corporate governance is the direct responsibility of the Board of Directors. The Board is committed to excellence in corporate governance, and adheres to rules of the High Level Controls Module (HC Module) of the Central Bank of Bahrain, and the principles of the Corporate Governance Code of the Kingdom of Bahrain issued by the Ministry of Industry and Commerce and best practices as per international standards.

Governance Framework

SICO’s corporate governance framework comprises the Board and the Board Committees, the Management reporting structure and the Management Committees, the Control functions such as Risk Management, Compliance, AML and Internal Audit, the Corporate Governance policy; Board and Committee Charters; Code of Business Conduct; operational policies and procedures; internal controls and risk management systems; compliance procedures; external audit; effective communications and transparent disclosure; and measurement and accountability.

The corporate governance policy should be read in conjunction with other Board approved polices & procedures.

Corporate Governance Principles

The Bank will follow the corporate governance principles as issued by the Ministry of Industry, Commerce and Tourism in the Corporate Governance Code and the CBB as per the High-Level Controls (HC) Module of the Rulebook. The principles are as follows:

- The Bank shall be headed by an effective, collegial and informed Board.

- The approved persons (as defined in CBB Licensing Requirements module) must have full loyalty to the Bank.

- The Board must have rigorous controls for financial audit and reporting, internal control, and compliance with law.

- The Bank must have rigorous and transparent procedures for appointment, training and evaluation of the Board.

- The Bank must remunerate approved persons and material risk-takers fairly and responsibly.

- The Board must establish a clear and efficient management structure.

- The Bank must communicate with shareholders, encourage their participation, and respect their rights.

- The Bank must disclose its corporate governance.

Role and Responsibilities of the Board of Directors

All directors must understand the board’s role and responsibilities under the Commercial Companies Law and any other laws or regulations that may govern their responsibilities from time to time. In particular:

- The board’s role as distinct from the role of the shareholders (who elect the board and whose interests the board serves) and the role of officers (whom the board appoints and oversees); and

- The board’s fiduciary duties of care and loyalty to the bank and the shareholders.

The Board is accountable to the shareholders for the creation and delivery of strong sustainable financial performance and long-term shareholder value.

The Board works together as a team to provide strategic leadership to staff, ensure the organization’s fitness for purpose, set the values and standards for the organization, and ensures that sufficient financial and human resources are available. Each director must consider himself as representing all shareholders and must act accordingly.

The Board’s role and responsibilities are outlined in the Board Charter of the Bank. The Board reserves a formal schedule of matters for its decision to ensure that the direction and control of the Bank rests with the Board. A summary of responsibilities should be disclosed publicly, for example in the annual report, which must be submitted to the CBB. This includes strategic issues and planning; review of management structure and responsibilities; monitoring management performance; acquisition and disposal of assets; investment policies; capital expenditure; authority levels; treasury policies ;risk management policies; the appointment of auditors and review of the financial statements; financing and borrowing activities; reviewing and approving the annual operating plan and budget; ensuring regulatory compliance; and reviewing the adequacy and integrity of internal systems and controls framework. As a minimum, the Board must:- Adopt and review annually the Bank’s strategy

- Adopt and review the management structure and responsibilities

- Adopt and review the systems and controls framework

- Monitor the implementation of strategy by management

- Review the Bank’s business plans and the inherent level of risk in these plan;

- Assess the adequacy of capital to support the business risks of the bank;

- Set performance objectives; and

- Oversee major capital expenditures, divestitures and acquisitions.

b) The management of the bank's compliance risk.

The Board is responsible for ensuring that the systems and controls framework, including the Board structure and organisational structure of the bank, is appropriate for the bank’s business and associated risks. The Board must ensure that collectively it has sufficient expertise to identify, understand and measure the significant risks to which the bank is exposed in its business activities.The Board must regularly assess the systems and controls framework of the bank. In its assessments, the Board must demonstrate to the CBB that:a) The bank’s operations, individually and collectively are measured, monitored and controlled by appropriate, effective and prudent risk management systems commensurate with the scope of the bank’s activities;b) The bank’s operations are supported by an appropriate control environment. The compliance, risk management and financial reporting functions must be adequately resourced, independent of business lines and must be run by individuals not involved with the day-to-day running of the various business areas. The Board must additionally ensure that management develops, implements and oversees the effectiveness of comprehensive know your customer standards, as well as on-going monitoring of accounts and transactions, in keeping with the requirements of relevant law, regulations and best practice (with particular regard to anti-money laundering measures). The control environment must maintain necessary client confidentiality and ensure that the privacy of the bank is not violated, and ensure that clients’ rights and assets are properly safeguarded; and

c) Where the Board has identified any significant issues related to the bank’s adopted governance framework, appropriate and timely action is taken to address any identified adverse deviations from these requirements.

The Chairman is responsible for leading the Board, ensuring its effectiveness, monitoring the performance of the Executive Management, and maintaining a dialogue with the Bank’s shareholders. The Chairman also ensures that new Directors receive a formal and tailored induction to facilitate their contribution to the Board. The induction must include meetings with senior management, visits to the Bank’s facilities, presentations regarding strategic plans, significant financial, accounting and risk management issues, compliance programs, its internal and external auditors and legal counsel. All continuing directors must be invited to attend orientation meetings and all directors must continually educate themselves as to the bank’s business and corporate governance.

When a new director is inducted, the chairman of the board, or the Bank’s legal counsel or compliance officer, or other individual delegated by the chairman of the board, should review the board’s role and duties with that person, particularly covering legal and regulatory requirements and Module HC of the CBB.SICO must have a written appointment agreement with each director which recites the directors’ powers, duties, responsibilities and accountabilities and other matters relating to his appointment including his term, the time commitment envisaged, the committee assignment if any, his remuneration and expense reimbursement entitlement, and his access to independent professional advice when that is needed.

The Board Charter serves as a reference point for Board activities and like best practice, develops as the organization grows with market and regulatory requirements. In addition to the roles and responsibilities, the Board Charter and Board Sub Committee Charters, define the ethical standard for business practices that are to be followed by each Board member.

Board Committees

The Board has delegated certain responsibilities to Board Committees, without abdicating its overall responsibility. This is to ensure sound decision-making, and facilitate the conduct of business without unnecessary impediment, as the speed of decision-making in the Bank is crucial. Where a Committee is formed, a specific Charter of the Committee has been established to cover matters such as the purpose, composition and function of the Committee.

The Board has three Committees to assist it in carrying out its responsibilities: The Investment Committee, the Audit & Risk Committee, and the Nominations, Remuneration and Corporate Governance Committee.

The board or a committee may invite non-directors to participate in, but not vote at, a committee’s meetings so that the committee may gain the benefit of their advice and expertise in financial or other areas. Committees must act only within their mandates and therefore the board must not allow any committee to dominate or effectively replace the whole board in its decision-making responsibility.

Committees may be combined provided that no conflict of interest might arise between the duties of such committees, subject to CBB prior approval.

A) The Audit & Risk Committee:

The board must establish an audit & Risk committee of at least three directors of which the majority must be independent including the Chairman. The committee must:- Review the Bank’s accounting and financial practices.

- Review the integrity of the Bank’s financial and internal controls and financial statements. The information needs of the Board to perform its monitoring responsibilities must be defined in writing, and regularly monitored by the Committee.

- Review the Bank’s compliance with legal requirements.

- Recommend the appointment, compensation and oversight of the bank’s external auditor.

- Recommend the appointment of the head of internal audit, head of Risk and head of Compliance.

- Support the board in its oversight and decisions related to the bank’s risk management framework.

- Include members who have experience in risk management issues and practices.

- Review and revise as may be required, the bank’s policies from a risk management perspective, at least every 3 years, unless there are material changes in the relevant rulebook requirements or to the business conducted by the bank and / or its risk profile.

- Oversee that the bank has in place processes to promote the bank’s adherence to the approved risk policies.

- Make effective use of the work of external and internal auditors. The committee must ensure the integrity of the bank’s accounting and financial reporting systems through regular independent review (by internal and external audit). Audit findings must be used as an independent check on the information received from management about the bank’s operations and performance and the effectiveness of internal controls.

- Make use of self-assessments, stress/scenario tests, and/or independent judgements made by external advisors.

- Ensure that senior management have put in place appropriate systems of control for the business of the bank and the information needs of the Board; in particular, there must be appropriate systems and functions for identifying as well as for monitoring risk, the financial position of the bank, and compliance with applicable laws, regulations and best practice standards. The systems must produce information on a timely basis.

B) Nomination, Remuneration and Corporate Governance Committee:

The board must establish a Nomination, Remuneration and Corporate Governance Committee of at least three directors which must:- Identify persons qualified to become members of the board of directors, Chief Executive Officer, Chief Financial Officer, Corporate Secretary and any other officers of the bank considered appropriate by the Board, with the exception of the appointment of head of internal audit, head of compliance and head of risk management which shall be the responsibility of the Audit & Risk Committee.

- Make recommendations to the whole board of directors including recommendations of candidates for board membership to be included by the board of directors on the agenda for the next annual shareholder meeting.

- Review the remuneration policies for the approved persons and material risk-takers, which must be approved by the shareholders and be consistent with the corporate values and strategy of the bank.

- Approve the remuneration package and amounts for each approved person and material risk-taker, as well as the total variable remuneration to be distributed, taking account of total remuneration including salaries, fees, expenses, bonuses and other employee benefits.

- Approve, monitor and review the remuneration system to ensure the system operates as intended.

- Recommend Board member remuneration based on their attendance and performance and in compliance with Article 188 of the Commercial Companies Law.

C) Investment Committee

The primary objective of the Investment Committee is to assist the Board in discharging their responsibilities in areas relating to Investments through the means of reviewing Investment policies, reviewing procedures to monitor the application of, and compliance with, the investment policies, approval and recommendation (where appropriate) to the Board of relevant Investment decisions (as defined in the Investment Policy Guidelines and Restrictions) and approve transactions that are above Management’s authority, but within the investment committee limits.The Committee also reviews strategic and budget business plans prior for submission to the Board, oversees the financial and investment affairs of the Bank and review major organisational changes.The detailed objective and scope of the committees are mentioned in their respective charters.Board and Committee Evaluation

The Board performs a self-evaluation on an annual basis. The Board annually reviews its Charter and its own effectiveness; and initiates suitable steps for any amendments. The Board also reviews self-evaluations of the individual Board members, Chairman and the Board Committees and consider appropriately any recommendations arising out of such evaluation.

b) Evaluating the performance of each committee in light of its specific purposes and responsibilities.

c) Reviewing each director’s work, his attendance at board and committee meetings, and his constructive involvement in discussions and decision makings.

d) Reviewing the board’s current composition against its desired composition with a view toward maintaining an appropriate balance of skills and experience and a view toward planned and progressive refreshing of the board.

e) Recommendations for new Directors to replace long-standing members or those members whose contribution to the bank or its committees is not adequate.

The board should report to the shareholders, at each annual shareholder meeting, that evaluations have been done and report its findings.Board Composition and Election

The appointment of the members of the Board of Directors of the Company shall be subject to the provisions of the Articles of Association of the Company and (Article 172 – Paragraph -1) of the Commercial Companies Law, and is subject to prior approval by the CBB. The classification of ‘Executive’ Directors, ‘Non-executive’ Directors and ‘Independent’ Directors is per the definitions stipulated by the CBB.

The Board Nomination, remuneration and Corporate Governance Committee identifies and screens suitable and qualified candidates as members of the board of directors and as and when such positions become vacant submit its recommendations to the whole board of directors who in turn propose to the next annual shareholder meeting for their approval.No person shall be appointed or elected as a board member unless he declares in writing his acceptance. The Board Nomination, Remuneration and Corporate Governance Committee makes considered recommendations to the Board of Directors with the objective to ensure appropriate Board composition; ensure appropriate nomination of Directors to the Board and its committees; improve the efficiency of the Board by enabling delegation of appropriate tasks to the Committee where such tasks should be discussed in sufficient depth; and consider whether succession plans are in place to maintain an appropriate mix of skills, experience, expertise and diversity on the Board. Directors are elected by the shareholders at the AGM, subject to the approval of the CBB, for a period of three years, after which they shall be eligible for re-election for a further three-year period. The three-year term of the board membership may be extended to a maximum of six months based on a Board request and subject to the CBB’s approval. The appointment of one person as both the Chairman and deputy Chairman is prohibited. Any person, who owns ten percent (10%) or more of the capital, may appoint members on the board of directors for the same percentage of the capital he owns, by rounding the digits of the number to the nearest round figure. If he exercises this right, he shall lose his right to voting for the percentage for which he appointed a proxy. Each person who has not exercised his right to appoint members on the board of directors, or who does not own a percentage qualifying him to appoint another member, may use this percentage in voting. His right to appoint members shall be forfeited in case he does not exercise it in any election or to appoint members on the board of directors, in each case separately, all unless it is provided otherwise in the company’s Memorandum or Articles of Association. The General Assembly shall elect the members of Board of Directors by cumulative secret ballot. A cumulative vote shall mean that each shareholder shall have a number of votes equal to the number of shares he owns in the company, and shall have the right to vote for one candidate or to distribute them among his chosen candidates. Each proposal by the board to the shareholders for election or re-election of a director must be accompanied by a recommendation from the board, a summary of the advice of the Nomination, Remuneration and Corporate Governance Committee, and the following specific information:- The term to be served, which may not exceed three years;

- Biographical details and professional qualifications;

- In the case of an independent director, a statement that the board has determined that the criteria of independent director have been met;

- Any other directorships held;

- Particulars of other positions which involve significant time commitments, and

- Details of relationships between: i. The candidate and the Bank, and

ii. The candidate and other directors of the Bank.

b) He must not have been convicted in a crime involving negligent or fraudulent bankruptcy or a crime affecting his honour or involving a breach of trust or in a crime on account of his breach;

c) He shall not be prohibited from being a member in the Board of Directors of a joint stock company;

d) The Chairman of the Board of Directors or the Vice Chairman, shall not combine their positions with the highest management position in the Company;

e) The Conditions and approvals determined by the Central Bank of Bahrain for appointing independent, non-executive and executive members of the Board of Directors;

f) Any other condition, which may be specified in the Company’s Memorandum or Articles of Association.

No Board member may have more than one Directorship of a Retail Bank or a Wholesale Bank. This means an effective cap of a maximum of two Directorships of banks inside Bahrain. Two Directorships of licensees within the same Category (e.g. ‘Wholesale Bank’) are not permitted. The Bank may approach the CBB for exemption from this limit where the Directorships concern banks or financial institutions within the same group.Once Person should not hold more than three directorships in public companies in Bahrain with the provision that no conflict of interest may exist, and the Board should not propose the election or re-election of any director who does.Each director must consider himself as representing all shareholders and must act accordingly. The board must avoid having representatives of specific groups or interests within its membership and must not allow itself to become a battleground of vested interests. If bank has controllers or a group of controllers acting in concert, the latter must recognise its or their specific responsibility to the other shareholders, which is direct and is separate from that of the board of directors.If the Bank has a controller, at least one-third of the board must be independent directors. Minority shareholders must generally look to independent directors’ diligent regard for their interests, in preference to seeking specific representation on the board.If the bank has controllers, both controllers and other shareholders should be aware of controllers’ specific responsibilities regarding their duty of loyalty to the bank and conflicts of interest and also of rights that minority shareholders may have to elect specific directors under the Commercial Companies Law or if the bank has adopted cumulative voting for directors. The chairman of the board or other individual delegated by the chairman of the board should take the lead in explaining this with the help of the bank’s lawyers.Independence Of Directors

In line with the requirements of the CBB’s HC Module and Article 240 of the Commercial Companies Law, the Bank has put in place Board-approved criteria to determine ‘Test of Independence’ using formal requirements as specified in the CBB rule book and other relevant requirements as assessed by the Board of SICO. The purpose of the Test is to determine whether the Director is: ‘Independent of management, and any business or other relationships, which could materially interfere with the Director’s ability to exercise objective, unfettered or independent judgement, or the Director’s ability to act in the best interests of SICO.

The Board strives to ensure that an adequate number of Independent Directors is present on the Board in line with CBB rulebook requirements subject to the Board resources and capabilities.Independence of Judgment

Every director must bring independent judgment to bear in decision-making. No individual or group of directors must dominate the board’s decision-making and no one individual should have unfettered powers of decision.

Board Meetings and Attendance

According to the Bahrain Commercial Companies Law and the CBB rules, Board meetings will be conducted at least four times a year (on a quarterly basis) and at least half of them in any twelve-month period must be held in Bahrain.

All Board members must attend at least 75 per cent of all Board meetings within a calendar year. At least 50% of the Directors must attend each Board meeting, including the Chairman or the Vice-Chairman. Voting and attendance proxies for Board meetings are prohibited at all times.In case a Board member has not attended at least 75% of Board meetings in any financial year, SICO must immediately notify the CBB along with a description of any mitigating circumstances affecting his non-attendance. The absence of Board members at Board and committee meetings must be noted in the meeting minutes. In addition, Board attendance percentage must be reported during any general assembly meeting when board members stand for re-election (e.g. Board member XYZ attended 95% of scheduled meetings this year).The Board Secretary (appointed by the Board) shall draw the minutes of each Board & Board Committee meetings mentioning the subjects discussed, decisions reached, names of members present & vote casted by each member against any decision taken during the meeting.The board should have no more than 10 members, and should regularly review its size and composition to ensure that it is small enough for efficient decision making yet large enough to have members who can contribute from different specialties and viewpoints. The board should recommend changes in board size to the shareholders when a needed change requires amendment of the bank’s Memorandum of Association.Directors’ Access to Independent Advice

The board must ensure by way of formal procedures that individual directors have access to independent legal or other professional advice at the bank’s expense whenever they judge this necessary to discharge their responsibilities as directors and this must be in accordance with the bank’s policy approved by the board.Individual directors must also have access to the bank’s Board secretary, who must have responsibility for reporting to the board on board procedures. Both the appointment and removal of the corporate secretary must be a matter for the board as a whole, not for the CEO or any other officer.Whenever a director has serious concerns which cannot be resolved concerning the running of the Bank or a proposed action, he should consider seeking independent advice and should ensure that the concerns are recorded in the board minutes and that any dissent from a board action is noted or delivered in writing.Upon resignation, a non-executive director should provide a written statement to the chairman, for circulation to the board, if he has any concerns such as those mentioned in the previous point.Remuneration Policy

The Bank’s total compensation approach, which includes the variable remuneration policy, sets out the Bank’s policy on remuneration for Approved persons and material risk-takers, and the key factors that are taken into account in setting the policy.

The Bank has adopted regulations concerning Sound Remuneration Practices issued by the Central Bank of Bahrain and ensures that its variable remuneration framework is in line with CBB requirement. It is the Bank’s basic compensation philosophy to provide a competitive level of total compensation to attract and retain qualified and competent employees. The Bank’s variable remuneration policy will be driven primarily by a performance-based culture that aligns employee interests with those of the shareholders of the Bank.

The Board of Directors remuneration is governed by provisions of Commercial Companies Law 2001 and the CBB. The Director’s remuneration is approved by the shareholders at the annual general meeting. In addition, the members are paid sitting fees for the various sub committees of the Board. The Board remunerations is reviewed by Nomination, Remuneration & Corporate Governance committee as per the remuneration policy. Directors remuneration is accounted as an expense as per international accounting standards and CBB regulations.

Annual General Meeting

The annual general meeting must be convened at least once a year, during the three months following the end of the financial year. The invitation of the General Assembly shall be sent by a registered mail, or in any other way, indicating the knowledge of the time, venue and the agenda of the meeting, at least twenty-one days prior to the meeting. The Bank must provide the CBB, for its review and comment, at least 5 business days prior to communicating with the shareholders, the draft agenda for any shareholders’ meetings.

The bank must invite a representative of the Ministry of Industry, Commerce and Tourism and the CBB to attend any shareholders’ meetings taking place. The invitation must be provided at least 10 days prior to the meeting taking place. The CBB may appoint one of its employees to attend but he shall have no right to vote. The matters reserved for the shareholders through Annual General Meeting include the following:All Directors are expected to attend the Annual General Meeting and to make themselves available during and after the meeting to answer questions from shareholders.

SICO’s Board must observe the following Commercial Companies Law requirements for shareholder meetings:Management

The Board delegates the authority for the day-to-day management of the business to the Chief Executive Officer, who is supported by a qualified senior management team. The Bank’s management is responsible for the implementation of appropriate procedures and processes in place to ensure adherence to the Board approved policies, laws, regulations and other guidelines to ensure appropriate Corporate Governance standards throughout the Bank.

Management shall be appointed under employment contract specifying the terms of the appointment. Management shall be accountable to the board and the committees of the Board. The Board Nominations, Remuneration and Corporate Governance Committee is also involved in annual performance evaluation of Senior Management of the Bank. The Bank’s management monitors the performance of the bank on an ongoing basis and advises the Board. The monitoring of performance is carried out through a regular assessment of performance trends against budget, and prior periods and collectively through three management committees: Asset Management Committee, Assets, Liabilities and Investments Committee; and Internal Control Committee.

The Asset Management Committee oversees the fiduciary responsibilities carried out by the Asset Management unit in managing clients’ discretionary portfolios as well as the funds operated and managed by SICO. It also reviews the investment strategy of the Bank’s funds and portfolios; reviews and approves portfolio performance; and reviews subscription and redemptions, and compliance.

The Assets, Liabilities and Investments Committee acts as the principal policy making body responsible for overseeing the Bank’s capital and financial resources. It is also responsible for managing the balance sheet and all proprietary investment activities, including investment strategy; and asset, country and industry/sector allocations. The committee is specifically responsible for managing the balance sheet risk; capital and dividend planning; forecasting; and monitoring interest rate risk positions, liquidity and funds management. The committee is also responsible for formulating and reviewing the Bank’s investment policies (subject to approval by the Board), strategies, and performance measurement and assessment.

The Internal Control Committee oversees the Internal Control functions carried out in SICO by various department. The remit of the committee is to look into strengthening the internal control culture throughout the company by ensuring that each department head takes ownership and responsibility and accountability for internal control. The committee is entrusted with the responsibility to consult and advice the Board of Directors in the assessment and decision making concerning the Bank’s system of risk management, internal control, and corporate governance.

Specific responsibilities have been delegated to each Management Committee and each Committee has its own terms of reference which includes detailed terms, role and responsibilities. The Bank has also well-established Control functions such as the Financial Control department, the Risk Management, Anti-Money Laundering and Compliance Function, the Internal Audit Function and the Internal Control Unit.

Extraordinary General Meeting

The matter reserved for the Extraordinary General Meeting include the following:- Amending the company's Memorandum or Articles of Association and extending the Company's term.

- Increasing or reducing the Company's share capital – including issuing new shares.

- The disposal of more than half of the assets of the company, subject to the provisions of Article (194 bis) of the Commercial Companies Law.

- Selling the entire project carried out by the company or disposing of it in any other manner.

- Winding up or conversion of the company or merging it with another company.

- Any other matters that are stated in the Commercial Companies Law.

Directors' Communication With Management

The Board encourages participation by management regarding matters the Board is considering, and also by management members who by reason of responsibilities or succession, the CEO believes should have exposure to the directors.

Code Of Business Conduct

SICO conducts itself in accordance with the highest standards of ethical behaviour. A Code of Conduct for SICO Staff has been developed to govern the personal and professional conduct of all employees. The Code of Conduct outlines areas of conflict of interest; confidentiality; fair and equitable treatment; ethics and acting responsibly, honestly, fairly and ethically; and managing customer complaints.

A Whistleblowing Policy and Procedures is included within the Code of Conduct for SICO Staff.

Whistleblowing Policy

The Board adopts the whistle blowing policy & enables the employee at all level to raise concerns against any malpractices or irregularities observed in the organization. SICO is committed to the highest standards of good governance, openness, transparency, integrity and accountability. Consequently, if any Staff Member have any well-founded "concerns", they have a duty to SICO and to the other colleagues to speak up and to report the situation immediately to their Department Head in "good faith" so that the matter can be investigated promptly.

Conflict Of Interest

Each approved person should make every practicable effort to arrange his personal and business affairs to avoid a conflict of interest situation with the Bank and shall inform the bank of any conflicts of interest as they arise and abstain from voting on any related subject matter. Each approved person is personally accountable to the Bank and the shareholders if he violates his legal duties to the Bank.

No approved person should put himself in a position where his personal interest conflicts or potentially conflict with those of the Bank. All approved persons including the Chairman are required to disclose their interests in other entities or activities (whether as a shareholder of above 5% of the voting capital of a company, a manager, or other form of significant participation) to the NRCG committee on an annual basis (Appendix A), such members may not attend the resolutions pertaining to their areas of personal interest and shall be recorded in the minutes of the meeting.

An approved person is considered to have a “personal interest” in a transaction with a bank if: a) He himself; orb) A member of his family (i.e. spouse, father, mother, sons, daughters, brothers or sisters); or

c) Another company of which he is a director or controller, is a party to the transaction, or has a material financial interest in the transaction.

The Board approval should be sought for such members and any outcomes relating to personal interest should be reported by the Chairman to the General Assembly, accompanied with a report by an external auditor and disclosed in SICO’s financial statements and annual reports with relevant details. If the Board approval was not obtained, those agreements or transactions may be invalid if the conditions were unfair or involves a conflict of interest. In addition, compensation may be payable to SICO in relation to any profit or gain generated from the relevant violation. An approved person must:a) Not enter into competition with the bank;b) Not demand or accept substantial gifts from the bank for himself or connected persons;

c) Not misuse the bank’s assets;

d) Not use the Bank’s privileged information or take advantage of business opportunities to which the Bank is entitled, for himself or his associates; and

e) Absent themselves from any discussions or decision-making that involves a subject where they are incapable of providing objective advice, or which involves a subject or (proposed) transaction where a conflict of interest exists.

SICO must have in place a board approved policy on the employment of relatives of approved persons and a summary of such policy must be disclosed in the annual report. The bank’s CEO must disclose annually to the Board those individuals who are occupying controlled functions and who are relatives of any approved persons within the Bank.Succession Planning

The Boards of Directors are responsible for key succession planning and ensures that succession planning is in place for all other key executive roles both in emergencies & normal course of business.

This includes identifying potential succession candidates and development plans for the CEO; and fostering management depth by rigorously assessing candidates for other senior positions.

The Board shall annually review and evaluate the succession plans and management development programs for all members of executive management, including the Chief Executive Officer.

Corporate Ethics

Each member of the board must understand that his duty of loyalty includes a duty not to use the property of the Bank for his personal needs as though it was his own property, not to disclose confidential information of the Bank or use it for his personal profit, not to take business opportunities of the Bank for himself, not to compete in business with the Bank, and to serve the Bank’s interest in any transactions with a company in which he has a personal interest.

Disclosure and Communications Policy

The Board must oversee the process of disclosure and communications with internal and external stakeholders. The Board must ensure that disclosures made by the bank are fair, transparent, comprehensive and timely and reflect the character of the bank and the nature, complexity and risks inherent in the bank's business activities.

The Bank has a responsibility to communicate effectively with the shareholders. Accordingly, the Bank’s annual report should disclose true and fair accounting information prepared in accordance with applicable standards; consider substance over form in the presentation of accounts; disclose and discuss all material risks; explain the rationale for all material estimates; show manner of compliance, or explain deviations, if any, with applicable corporate governance codes; discuss goals, plans, and progress. The annual reports of the Bank shall present report on corporate governance in a separate section with details and descriptive on how the Bank has applied the principles of corporate governance.

The Bank has to conduct all communications with its stakeholders in a professional, honest, transparent, understandable, accurate and timely manner. Main communications channels include an annual report, corporate website, and regular announcements in the appropriate local media. To ensure disclosure of relevant information to all shareholders on a timely basis, the Bank publishes its annual report and the past ten years’ financial statements on the corporate website - www.sicobank.com.

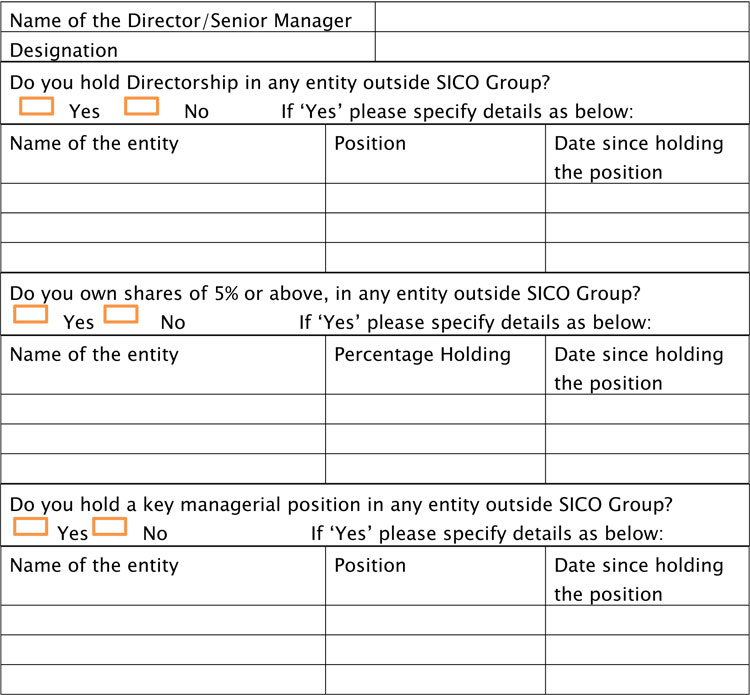

Appendix A

Disclosure of Interest in entities other than SICO BSC

The CBB’s High Level Controls (HC) module HC 2.4.1 requires all approved persons to declare in writing on an annual basis, all of their interests in other entities or activities (whether as a Director, or shareholder of 5% & above in the voting capital, or holding a managerial position, or other control whether direct or indirect).

I hereby declare that the above information is true and correct and made in compliance with the relevant provisions of the CBB Rulebook and the Commercial Companies Law.

If any of the above information changes either by way of additional disclosure requirements, or amendments to the existing disclosure due to a change in my status of relationship, I undertake to notify the Board immediately with revised/updated declaration form.